When developing an Internet of Things (IoT) and machine-to-machine (M2M) strategy, telecoms operators typically give only limited consideration to geographical factors. Operators are structured to win national contracts and yet few IoT or M2M contracts are truly national.

Many are awarded either at the international or local levels. As Tom Rebbeck of Analysys Mason says, telecom operators may need to think more about the geographical dimension to their IoT and M2M strategy if they are to take advantage of opportunities.

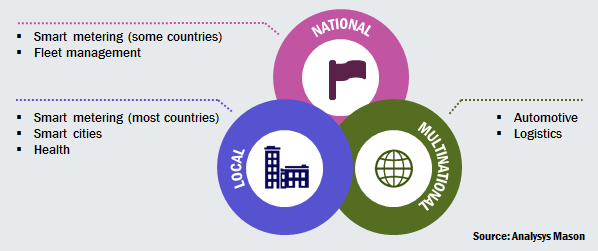

Contracts can be classified by where the award is made – either at the local, national or multinational levels (see Figure 1). The structure of telecoms operators may cause them to miss local opportunities and be poorly suited for those at the international level.

Figure 1: Examples of IoT and M2M opportunities by geography type

Operators are becoming less well equipped to deal with large multinational deals

The trend among telecoms operators is no longer to have large footprints over many countries, but to have a deeper presence in a smaller number of countries.

For example, if BT’s acquisition of EE is approved, France Telecom will significantly reduce its investment in the UK, and Telefónica will leave the country if Hutchison Whampoa acquires O2 UK. Furthermore, Vodafone and Liberty Global are discussing an asset swap, which presumably could result in a single fixed–mobile operator and one fewer multinational operator in the UK.

Multinational companies, particularly car manufacturers, do not want to make agreements with many operators each in single countries. Instead, they would like to reach overarching regional deals.

The fragmentation of operator footprints will increase the emphasis on international M2M associations (such as the Global M2M Association or the Bridge Alliance) and bilateral partnerships between operators (such as Vodafone’s with Belgacom, SFR and others). Operators will need to consider whether M2M alliances and partnerships go deep enough. While the focus of these alliances is typically to provide connectivity in multiple countries, customers may want them to support more complex requirements, such as service-level agreements (SLAs). These alliances and partnerships may need a degree of autonomy and even control over their members to meet fully demand from potential multinational clients.

Operators are losing local deals to more flexible players

The national structure of telecoms operators may damage them in relation to local deals. Many operators are considering which, if any, of the low-power, wide-area (LPWA) network technologies to support, with a view to building a nationwide network mirroring, or extending, the coverage of traditional cellular solutions. While these operators perform technical trials and assess the business case, smaller more nimble players are building private networks for individual local problems. For example, Smart Parking has built a parking solution, including network and sensors, for Westminster Council in London, while Telensa has won smart city contracts in a number of cities, including Moscow where it claims to have the largest parking monitoring system in the world. In a classic example of Christensen’s ‘innovator’s dilemma’, many telecoms operators are undecided as to how to approach LPWA, while other providers are winning contracts. By the time operators decide to invest, the most attractive metering, parking and other city applications, most of which are essentially local, may already been locked down by other providers.

Rather than procrastinate about which technology to deploy for a national network, telecoms operators may wish to consider how they could be flexible and chase local deals.

For good reason, telecoms operators have built their businesses around providing nationwide cellular coverage, and wide coverage has been a key differentiator. As we have discussed in a previous article, M2M and IoT have fundamental differences from the existing business and may require new approaches. As one of these new approaches, operators may need to think more about the geographical element of contracts, and may need to explore deeper international partnerships for multinational opportunities and flexible solutions for the local market.

The author of this blog is Tom Rebbeck, research director – Digital Economy, Analysys Mason