Until now, consumers have interacted less with insurers than with any other industry, so the consumer experience with insurers tends to lag behind others.

However, Internet of Things (IoT) technologies will drive fundamental change in this respect, and facilitate the adoption of new communication channels in the insurance business. Insurance companies will meanwhile find it very useful to get insights into customer communication best practices from other industries, writes Gorjan Agacevic & Marijan Mumdziev of Amodo

Customer communication for the telematics-based insurance products has not been getting the deserved attention. In this whitepaper, we summarise currently available market research on the topic of customer communication in insurance business and combine it with our own research in order to give the comprehensive view on this important issue. For the purpose of this whitepaper, Amodo researched close to 50 different insurance companies which offer telematics-based insurance products.

Internet Of Things paradigm

Telematics, home automation, wearables and other Internet of Things technologies have one thing in common when it comes to insurance business, they are all disruptive and will change the face of the industry in the next 5 – 10 years. Not only is the product portfolio and business models changing with this technology, but also the nature of the customer relationship. Perhaps the latter one being the most important.

Ownership of customer relationship shapes the industry

As is the case for many insurance companies, customer relations are often managed by agents or brokers. This imposes an obstacle in efficient prevention of the customer churn and management of customer loyalty. Customer loyalty, to a much bigger extent than in other industries, depends on the relationship that insurance agents establish with the customers and insurance company with insurance agents. Thus, one of the most important business assets – customer relations, remains under limited control of the insurance company.

Usage-based insurance programs are a game changer in that respect, as they enable insurance companies to establish new direct communication channels towards customers and eventually gain ownership of customer relations. This will be a significant shift for the further industry development, which would benefit those with direct customer access, and weaken those without.

Shift from bricks-and-mortar to digital channels

According to Ernst &Young Global insurance consumer survey from 2014. 44% of insurance customers have no interactions with their insurers for periods of over 18 months.

Actually, one of the key findings of this study was that insurance customers want more frequent, meaningful and personalised communications with insurance companies. Surely, customer relationship strategies will revolve around establishing an efficient communication channel with the end customer.

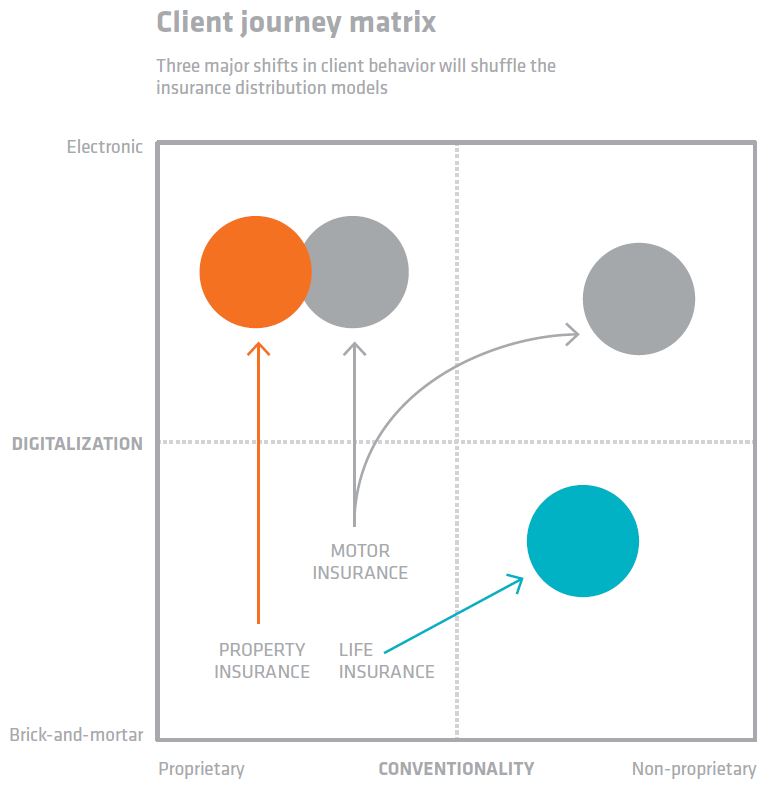

According to the same Ernst & Young study, more than 80% of insurance customers are willing to use digital and remote channel options for different insurance related tasks and transactions. This appears especially relevant for motor insurance products, according to Roland Berger Strategy Consultants that clearly outline the trend of motor insurance customers to switch from proprietary brick-and-mortar channels to non-proprietary electronic channels.

As their customers switch from proprietary to non-proprietary channels, insurance companies will need to rethink their distribution and communication strategy in order to accommodate the growing market segment of the customers prone to digital communication channels.

Usage-based insurance programs facilitate faster shift to digital channels

Usage-based insurance products fit very well into strategies of those insurance companies that recognised the need to:

- turn to digital solutions in order to create new communication channel,

- establish more frequent and efficient communication with their customers,

- generate more up-sell and cross-sell through better and closer customer

Usage-based insurance products provide valuable and relevant content for the insurance customers., and it is exactly that kind of content that motivates customers to interact with insurance communication channels more frequently. Several insurance companies offering usage-based insurance, reported frequency of more than 10 visits a month for the customers checking their online driving score. Carrot Insurance and Ingenie, both reported significant improvement of the customer driving behaviour for their UBI programs through increased customer engagement. Ingenie claims that drivers who engage with feedback just once or twice a month, reduce their crash risk by 22%. On the other hand, those who engage with their feedbacks two to five times a month are 42% less likely to crash than those who don’t check at all. Higher engagement leads also to increased cross-sell ratio as reported by Allianz on Allianz Capital Markets Day, Allianz Insurance Germany, Berlin, June 25, 2013.

One of the challenges in decision-making progress on whether to implement a usage-based insurance program is surely a lack of transparency of the business case. Starting from the relevant content, driving frequent communication with the customers, increasing the customer loyalty through differentiators and additional value, to improved loss ratio and cross-sell ratio, it is difficult to give a reliable estimate on the return of the investment. Nonetheless, shift to digital is opening a new era of customer communication, which unarguably brings substantial benefits for both – insurance customers and insurance companies.

Comment on this article below or via Twitter: @M2MNow OR @jcm2m