In their surveys, McKinsey and many other analysts are promising the massive arrival of robots in our factories, our service companies, our cities, our countrysides and our homes. Whatever the editorial stance and target audience, all of the media are talking about robotics in just about every issue or report published.

Yet the reality of the robotics transformation varies depending on the country and continent, and many innovations are having a hard time carving out a significant place for themselves on the market, says Catherine Simon, Innorobo.

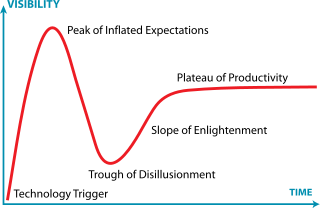

Have we arrived at the peak of the Gartner Hype Cycle for Emerging Technologies, at the point of “inflated” expectations? Everyone keeps talking over and over about the Robolution, but where does it really stand as we speak?

1. Industrial robotics

According to the International Federation of Robotics (IFR), in 2014, sales of industrial robots grew 29%, reaching nearly 230,000 robots sold worldwide. China alone accounts for 25% of these sales, up 56% compared to 2013. The Asian giant is getting equipped primarily with “standard” industrial robots.

The USA purchased 32,600 industrial robots, an 8% increase compared to 2013. Europe has seen moderate growth in its purchases of industrial robots, which rose by around 4%. Once again, the automotive and electronics industries are driving growth in this market. But what about other manufacturing sectors?

These figures, used as the reference for the worldwide robotics ecosystem, are considered as too high by Robotenomics (http://robotenomics.com/2015/10/28/are-sales-of-robots-overstated-and-overhyped/).

Whatever the figures and whatever we make them mean, after 10 years of integration and immersion in the worldwide robotics ecosystem and on the eve of the 6th edition of Innorobo, we would like to take a closer look at the 3 big trends we see in industrial robotics:

a) Incremental innovation in “standard” industrial robots

We are today in the era of continuous improvement and optimisation. Innovations in mechatronics – in components like gears and gearboxes, controllers, bearings, actuators and more – and breakthroughs in interface or command software, etc. are increasing the performance of industrial robots in terms of precision, speed and robustness. Here, the aim is clearly higher productivity.

b) The emergence of Softrobotics

To meet the industrial challenge of small-run production and “personalised” manufacturing, research is geared towards making industrial robots more versatile. One of the most interesting emerging innovations in terms of market potential involves grippers.

At the crossroads of materials science and robotics, softrobotics has moved from the laboratory to the commercialisation phase in two years. These “universal” grippers use the properties of soft materials that adapt to the shape of the object to be grasped through electroadhesion or pneumatic systems. For more information, see https://vieartificielle.com/prehension-robots

c) The range of collaborative robots is large, but struggling to “transform” the market

According to Barclays Equity Research, 4,300 collaborative robots were sold in 2015, accounting for an estimated US $126 million in sales. This is indeed a more than 70% increase compared to 2013, yet the volumes are still quite small (equivalent to less than 2% of sales of “standard” industrial robots).

The range of collaborative robots, which emerged 4 years ago with Baxter, the pioneering “cobot” by Rethink Robotics, is now diversified and technically sound. This major innovation in industrial robotics is having a hard time breaking into the multiple markets it targets.

There are two reasons for this:

The first is the problem of safety standards. Although the ISO 10218 and ISO/TS 15066 standards call for safety measures for human-robot collaboration, integrators have to implement new processes for design, integration, programming and maintenance, as well as new risk analysis measurements that take into account not only the versatility of the tasks a robot is given, but also all of the data from the robot’s “open” environment.

The second issue is economic in nature. Indeed, these collaborative robots have a sticker price around 10 times lower than their “standard” counterparts, and this ratio is the same for installation costs. Thus, from an economic standpoint, the collaborative robotics market is far less appealing integrators than their traditional “standard” industrial robotics market.

Let’s hope that advances in Man-Machine interfaces made primarily with a view to massive adoption of collaborative robots is enough to quickly drive the market upwards, as collaborative robotics promises – beyond simple gains in productivity – to make workers’ jobs less difficult without replacing humans entirely.

2. Professional service robotics

A value chain to be built around the “Robot As A Service” model

As a reminder, “professional service robotics” involves B-to-B service robots (robots not assigned to manufacturing or production tasks, yet geared towards a professional market). The professional service robotics market was estimated at US$ 3.7 billion in 2014, a 3% increase compared to 2013.

Here again, the “Robolution” is anything but exponential! Nonetheless, over the past 5 years, many of the products in this range have moved from the prototype phase to market-ready solutions. Admittedly, some platforms have managed to break into the market, for example “outdoor” robots – autonomous vehicles, exploratory robots and agricultural robots account for 37% of the market in terms of value and grew 25% between 2013 and 2014.

This growth has been boosted by drones, namely in defense applications, and reflects the relative success of cow milking robots. Logistics robots account for 17% of the service robotics market in terms of value, showing 21% growth between 2013 and 2014.

Professional service robotics is still a long way from transforming all service activities. Yet, medical robotics (35% of the market in terms of value, with a 9% decrease in growth between 2013 and 2014) enables safer surgical procedures and faster, more effective rehabilitation.

It is one potential solution to the challenge of an aging population, it offers the prospect of new practices to treat diseases that have until now been incurable, and it may potentially eliminate the world “disability” from our vocabulary. At the same time, the “Hospitality” market in general is eager for solutions to increase productivity and improve customer service.

Alongside this, robotics is making its first incursions in the distribution business with Pepper (by Aldebaran Robotics/ Softbank) as an ambassador at Nespresso stores in Japan, at a few Carrefour stores in France, at Oshbot in the US, at Lowe and Futurerobot stores in Korea, and at shopping malls and other public spaces.

Thus, in many fields, there is a great demand for technological solutions and the offer is starting to become more structured. The issue of deployment is, in the end, a question of value chain and business model. Service companies, unlike their industrial counterparts, are not used to buying machines that require large-scale investments: they mainly buy other services.

As well, professional service robots, like industrial robots, require the expertise of installers and integrators. In order for professional service robotics to deliver on its promise to trigger the “robotic” transformation of our economy, the nascent “Robot As A Service” business model must be developed, and intermediary companies – service robot integrators for each sector of activity (medical, hospitality, professional cleaning, etc.) – must be founded.

3. Personal service robotics

Two killer apps: the vacuum cleaner and the recreational drone!

Personal service robotics is a US $2.2 billion market in the United States, up nearly 30% in terms of value between 2013 and 2014. Two major categories of personal robots alone account for more than 99% of the market: robots that handle household chores – vacuum cleaners and lawnmowers – and educational and recreational robots.

The year 2015 was highlighted by very high-profile fundraising for social robots – namely for Jibo by MIT’s Cynthia Breazeal, which raised over US $60 million and France’s national social robot Buddy by Bluefrog, which exceeded its Indiegogo crowdfunding target by 300%, raising €300,000. These robots are not yet on the market, but they are generating huge amounts of hype as precursors of what the companion robot could be in terms of Man-Machine interface.

Still, their functionality is limited. Alongside this, one of 2015’s hottest Christmas gifts, with what could amount to nearly a million units (NB: unofficial figures that need to be checked) shipping out, was the recreational drone. China is the uncontested leader on this market, namely with DJI, though here again France has its national champion with Parrot.

Robotics companies that want to break into the consumer market are still seeking out the next killer app. Will it be the robot window washer? The Grillbot, which cleans your barbecue? Or the Internet of Things (IoT), which will be augmented to become the Internet of Robotic Things (IoRT)? Or the social robot in 2017? I don’t think anyone really knows today.

4. You say you want a Robolution?

While preparing for this yearly update on the figures in the robotics field, I read and compared a number of reports and articles, all – or nearly all – of which described robotics as a “General Purpose Technology”(GPT). As defined by Wikipedia, a GPT can affect an entire economy and has the potential to radically change society through its impact on pre-existing economic and social structures.

The examples of GPTs given are the steam engine, electricity, the automobile and, of course, Internet. Only the debate on “Robotics and Employment”, our fear of Artificial Intelligence that could overwhelm humans or, even worse, the end of humanity and the advent of transhumanism corroborate the notion of robotics as a GPT, a vision that is destructive rather than transformative.

Yet, for more than 5 years, Innorobo has been claiming that robotics technologies provide potential solutions to our major societal challenges. Precision agriculture is helping to save our planet, and robotics technologies applied to the energy, recycling and waste management sectors can transform the way we consume natural resources by optimising our use and distributing it based on real needs.

Medical and healthcare robotics can eliminated the word “disability” from our vocabulary and give new autonomy to our elderly citizens. The list goes on and on. In industry, do we really need to produce more at a lower cost or rather give humans back a sense of pride in their profession and know-how while making their work less physically demanding?

While technology is a means, it is not there to give us meaning. Robotics technologies are going to continue to advance with, if we believe Moore’s Law, an “inflection point” in the next 10 to 20 years, followed by rapid progress.

The global robotics ecosystem gathered at Innorobo – with representatives from the scientific, educational, industrial, service, financial, economic and political spheres, as well as the general public – has a duty to determine another prospective vision for robotics technologies, with the aim of a society in which General Purpose Technologies help to improve the lives of all citizens while preserving our planet for sustainable humanity.

The author of this blog is Catherine Simon, Innorobo.

About the author

Innoecho™ SAS has been found in November 2011 by Catherine Simon, consultant in strategy and international business development in the field of new technologies. A graduate of EMLYON Business School and INSEAD certified coach, Catherine has 25 years of experience at management level within or serving innovative SMEs in consumer electronics and robotics.

Driven by a genuine interest to prospective and innovations that contribute positively to society, it is one of 100 personalities who make the French Tech according to Challenges (March 2014). She won the “Trophy of Economy of Women” in 2014 in the category New technologies in Rhône-Alpes.

She is the guest of Les Echos in 2016 for the special edition “La Relève”, Les Défricheurs which brings together 200 French personalities who are resolutely turned towards the future.

Comment on this article below or via Twitter: @IoTNow_ OR @jcIoTnow