Smart home service companies are missing opportunities with the wrong messages sent to the wrong people, says Boston-based Strategy Analytics.

By a lucky chance the analyst is also reporting the availability of a new customer segmentation plan for the United States. This, it says, will help smart home product and service providers improve their marketing and communications strategies.

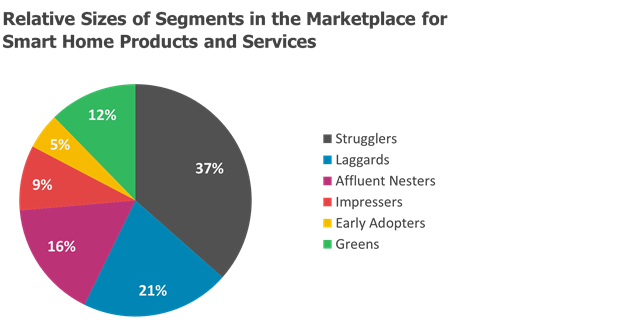

The segmentation identifies six groups, ranging from Laggards to Affluent Nesters, all of which are potential customers for smart home products but which must be targeted in different ways. Strategy Analytics used a Latent Class Analysis methodology; this avoids the pitfalls of traditional age- and demographic-based approaches, which mistakenly assume that everyone of a certain age behaves the same way.

Some smart home products and services have struggled to gain acceptance because they focus on issues which are less relevant to certain customer segments. For example, some people are less interested in technology, but are willing to pay for products and services that are environmentally friendly or will help them to better manage their homes.

“The idea of home management encompasses everything from energy management to budgeting to maintenance and repair,” said Bill Ablondi, director of Strategy Analytics’ Smart Home Strategies service. “To appeal to a mass market, companies should focus on solving real problems for consumers.”

The segments identified by Strategy Analytics are:

Strugglers

- This group is the largest, and also the most challenging to reach. They have lower incomes, very little interest in technology, and do not frequently invest in updates and improvements to their homes. Most smart home products and services are unlikely to resonate with this segment.

Laggards

- Laggards, not unlike the Strugglers, will be challenging to reach. They have relatively low incomes and little interest in the latest technology. However, many do put time and effort into having nice-looking, well-run homes.

Affluent Nesters

- Affluent Nesters are a high-priority segment for companies marketing smart home products and services today as they are both interested in technology and willing to invest in their homes.

Greens

- Greens, as the name suggests, are motivated much more so than other consumers by their concerns for the environment. Yet, they aren’t an early adopter group, which will make marketing smart home products and services to them a challenge.

Impressers

- Impressers want to gain the envy of those around them, which means that they’re willing to pay for home updates and improvements as well as the latest technology. This group is a prime target for companies in the smart home space.

Millennials

- Millennials are a tech-friendly group that prioritises convenience, which make them another target group for companies delivering smart home solutions.

“There are some consumer groups that will be easier to reach than others,” said Joe Branca, principal Industry analyst at Strategy Analytics. “This research helps to identify some of the challenges associated with reaching customers outside of the early adopter segments.”

Strategy Analytics surveyed a total of 2007 smartphone owners who own or rent their own residences in the United States. The survey was conducted in the latter half of 2016 and the data was weighted by age and gender to demographically reflect the population of smartphone owners.

Comment on this article below or via Twitter: @IoTNow_ OR @jcIoTnow