According to the Chinese zodiac, the Year of the Dog began on 16 February 2018. While the future is always shrouded in uncertainty, one of the most certain predictions for the year is that narrowband IoT (NB-IoT) will hit China’s tech sector with full force. Huawei predicts 150 million NB-IoT connections by the time for next year’s spring festival and China’s Ministry of Industry and Information Technology (MIIT) has set a national target for 600 million NB-IoT connections by 2020, writes Tobias Ryberg, a co-founder of analyst firm Berg Insight

Elsewhere in Asia-Pacific, Europe and other regions, more than 40 mobile operators expect to see the first large-scale deployments of commercial applications based on the latest new addition to the 3GPP family of standards. The global roll-outs herald a new phase in cellular IoT with new opportunities and threats to the industry. Once the technology is in place, it is time to start making business. For hardware vendors and connectivity providers, the challenge is make sure volumes grow faster than the rate of price erosion. On the applications side, the key is to identify scalable business opportunities that appeal to large customer segments.

The next phase in cellular IoT begins now

China is driving a major paradigm shift in the global cellular IoT industry. The country has embarked on one of the world’s largest digital infrastructure projects that will result in billions of new connected devices in the coming five years. NB-IoT has been designated as the country’s preferred low power wide area (LPWA) network technology and plays a key role in the national policies. The state-controlled mobile operators are deploying nationwide network infrastructure and subsidising hardware in a concerted effort to accelerate the transition from 2G to 4G in the already booming domestic cellular IoT market.

Similar changes are also happening at a slower pace in other parts of the world. In Europe, the leading mobile operators are making good progress towards ubiquitous coverage for NBIoT. Vodafone has been among the leaders in the development of the standard and will roll out commercial services across all its networks until 2020. At the end of 2017, the operator had live NB-IoT services in Italy, Spain, Ireland and the Netherlands. During 2018, availability will be extended to Germany, the UK and Czechia. Deutsche Telekom launched in Germany and the Netherlands in Q2 of 2017 and plans to extend coverage to an additional six European countries.

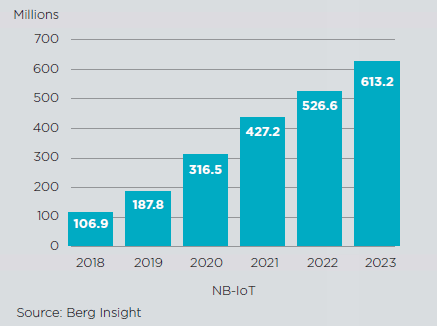

Other European operators with live NB-IoT services in early 2018 included Orange, TIM and Telia. Telefónica will start deployments in Europe later this year. Adoption in North America is also starting to take off. T-Mobile USA switched on NB-IoT services in Las Vegas in February this year and Verizon has confirmed plans to build a nationwide network covering 2.56 million square miles by the year-end. Australia, Singapore, South Africa, South Korea, Turkey and the UAE are other examples of countries where rollouts are already underway. Supported by global network deployments, Berg Insight expects that yearly shipments of NB-IoT devices will grow at a compound annual growth rate (CAGR) of 41.8% from 106.9 million units in 2018 to 613.2 million units in 2023.

(World 2018–2023)

Turn volume growth into revenue streams

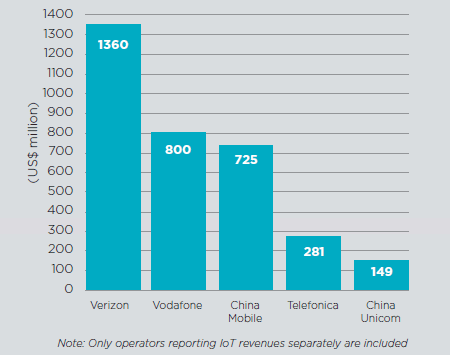

The next generation of cellular IoT networks can support an exponential increase of the number of connected devices. This capacity will be needed. China Mobile’s annual report for 2017 revealed that the operator added on average ten million new cellular IoT connections per month during the year. At the end of the period the operator had 229 million connected devices. More connections do not however automatically translate into proportionate revenue growth. In the same period, China Mobile’s IoT revenues increased by a more modest 44% to CNY 5.5 billion (US$725m). That is roughly half of Verizon’s IoT business and less than Vodafone generated from an installed base of 67 million connected devices.

Calculated based on the average number of connected devices on the China Mobile’s network over the year, the average revenue per device dropped by 48% from CNY 64 (US$8.4) in 2016 to CNY 33 (US$4.4) in 2017. There are two possible explanations for those results. Either the bulk of the new devices connected in the year generate extremely low ARPU, or else there is a significant share of non-revenue generating devices included in the operator’s IoT subscriber base. There are indeed some question marks around the sustainability of the Chinese IoT market and its exceptional growth. Recent footage showing piles of smart bikes rounded up by city authorities to be discarded just a few months after they were put into use and that must be taken as a worrying sign.

The biggest challenge for traditional telecoms players in the next phase of the development of IoT will be how to turn massive volume growth into significant revenue streams. Typical NB-IoT use-cases with expected yearly revenue streams of US$1 per connection must be deployed at immense scale to generate meaningful cash flows. One way of achieving this will be to tap into new application areas where NB-IoT is an important enabling technology such as Industry 4.0 and connected consumer products. Verizon reported the highest public IoT revenue figure among the world’s mobile operators of US$1.4bn in 2017, largely because it is the world’s largest provider of fleet management services for commercial vehicles. The players who identify and monetise similar opportunities in emerging application areas like asset management and transport tracking will be well positioned to become future revenue leaders in cellular IoT.

Industry 4.0 gains momentum

NB-IoT and other LPWA technologies create new opportunities for intelligent networking and automation in the enterprise and consumer space. A web of connectivity reaching from the supply chain to the end consumer can reduce cost and improve the customer experience. Industry 4.0 is a name for the current trend of automation and data exchange in manufacturing technologies. From a cellular IoT perspective, the main implication of the concept is that the flow of raw materials, parts, components and finished goods will be networked. The networking requires the presence of communication technology in transport vehicles, pallets and parcels. Beyond the point of manufacturing, the same form of connectivity will be required in the distribution chain, across distributors, retailers and into home delivery.

Manufacturing companies are starting to develop Industry 4.0 concepts for their supply chains. Many consumer brands are experimenting with connected products. In between, transport and logistics companies have long experience of tracking goods and now look to the opportunities with real-time tracking on a resolution down to individual packages. Adoption in developed economies is mostly market-driven with enterprises going through cycles of pilots, evaluation and implementation based on return on investment (ROI) calculations. The process is protracted and complex due to the number of players involved in any value chain. China is taking a very direct approach, essentially mandating that the largely state-controlled enterprise sector must implement Industry 4.0 concepts as quickly as possible. It remains to be seen if the eastern or western approach will be more successful from an economic point of view. From a technology perspective, China’s push will however certainly drive innovation and reduce the cost of communication technologies by creating massive demand.

Industry 4.0 will drive demand for LPWA connectivity especially in supply-chains. One of the main volume applications will be ultra-lowcost tracking devices. At some point, radio frequency identification (RFID) tags and barcodes will be replaced by active trackers. There is a growing consensus in the transportation industry that pallet tracking becomes economically viable at a unit cost around US$5. Active tracking of individual parcels is today economically viable on highvalue products. Lower cost and infrastructure for recycling trackers will progressively lower the threshold. Technology innovations like printable RF chipsets and disposable batteries for onetime use will be key enablers for volume growth.

Redefine consumer experiences through connectivity

The concept behind Industry 4.0 applies equally well to consumer markets. Post-sale, the digitised consumer brands of the 21st century will seek to build a web of connected products to build a stronger relationship to customers and offer improved customer experiences. The prime example is the smartphone, through which brands like Apple and Samsung interact with consumers on a daily basis. Many consumer products will increasingly resemble smartphones by becoming more dynamic and interactive. Whitegoods and other home appliances will be early volume segments.

One example of future trends can be seen in air conditioners. Leading Chinese brands are adding connectivity to their products for multiple reasons. It improves the customer experience by allowing the consumer to switch the appliance on and off remotely. The same capabilities can also be used to participate in energy management schemes where the local power utility can switch off loads to avoid demand peaks. On top of that, connectivity enables a new business model where cooling is sold as a service. In emerging economies with booming urban populations who live on low income, pay-as-you-go business models have already proven highly successful in the mobile industry. Applying the same model to consumer appliances has a great potential for generating growth. The early efforts of the bike sharing industry can provide a glimpse of the future.

Connected consumer products will become prevalent in all parts of the world. There will however be significant differences in how products are being networked. In developed economies with high fixed broadband penetration, smart home gateways and managed Wi-Fi/Bluetooth connectivity will be key enablers. In mobile-first markets, cellular is the only connectivity option. Therefore, connected consumer products will predominantly use ultra-low-cost cellular communication. The trend is starting in China and will eventually spread to other regions. NBIoT is going to be the primary enabling technology, with 2G as an intermediary solution for early adopters.

OEMs versus aftermarket and the rise of new service provider categories

The Industry 4.0 technology landscape offers significant opportunities for new categories of IoT solution providers. General packet radio service (GPRS) enabled the rise of telematics service providers that today offer a wide range of applications for connected cars and fleet management. NB-IoT will similarly enable the rise of dedicated service providers in the fields of asset management and transport tracking. Just as in vehicle telematics, there will be both original equipment manufacturer (OEM) and aftermarket solutions available on the market. A key lesson learned from the telematics industry is that aftermarket providers are more flexible than OEMs and faster to market with new innovations. On the other hand, OEMs have an advantage in developing more advanced applications as they have full access to all data in their own products.

Berg Insight

Asset management is an application area where aftermarket solutions have major advantages. Any organization that decides to network all of its assets will have to deal with a significant installed base where connectivity will be retrofitted. The biggest challenge of such a project is how to access more than just basic physical data like position, acceleration and temperature. The telematics industry was lucky to have the standardised on-board diagnostics (OBD2) interface available in all vehicles. Originally intended for engine inspection, it was able to provide rich data about the status and condition of the vehicle. Asset management solution providers would benefit greatly from a similar standardised interface for embedded systems. OEM solutions can provide higher value, but only for specific asset categories.

Transport tracking is even more open for third party solutions. Complex industrial supply chains involve multiple parties and modes of transport. The digital organisations that want real-time information about the flow of goods and products will be able to do that by keeping track of containers, pallets and parcels. The primary role of a transport tracking solution provider will be to make those objects intelligent and networked so that they can sense their contents, track their movements and report this information.

NB-IoT meets the technical requirements for container and pallet tracking, but not for parcels. Apart from the cost, the environmental aspect of disposable trackers is highly troublesome. A potential solution to the problem can be found in the beverage industry where billions of cans and bottles are being recycled through an extensive network of machines. An intelligent connected parcel, which can be recycled at the nearest convenience store, would revolutionise e-commerce.