The Internet of Things (IoT) is an increasingly important technology element for companies of nearly all sectors and around the world. For many firms it has become one of the pillars of their digitalisation strategy, promising the enablement of new business cases such as predictive maintenance, fleet management, infrastructure monitoring or analytics-based process optimisation. As part of these connected solutions few companies today build the whole solution themselves from scratch. Rather, IoT – software – platforms have emerged as a crucial enabling element. For companies deploying connected solutions or building connected operations, choosing a platform that is easy-touse, comes with the right features and a strong partner ecosystem has become a topic of major strategic importance. Following months of research, the recently published IoT Analytics’ IoT platforms market report and vendor comparison examines the role of IoT platforms in the Internet of Things and this article, written by Padraig Scully the chief research officer at IoT Analytics, reveals some insights from that research.

First, it’s important to define terminology and set out a definition of an IoT platform. IoT platforms are a piece of modular software technology that enable solutions for IoT device connectivity, device management, data management in the cloud, application development and enablement, and advanced analytics.

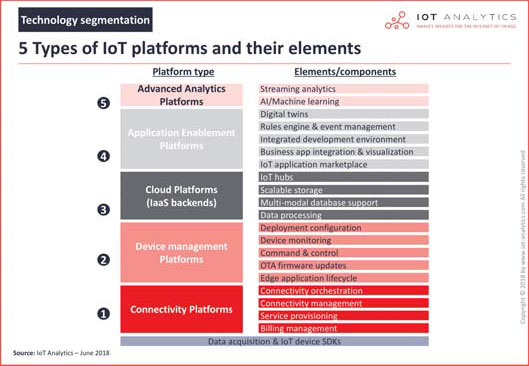

There are five types of IoT platform:

- Connectivity platforms: are a form of Platform-as-a- Service (PaaS) that offer coverage capabilities and solutions for connecting the IoT device, managing and orchestrating connectivity, and provisioning communication services for connected IoT devices.

- Device management platforms: are a form of PaaS or device cloud that handle provisioning tasks to ensure connected devices are deployed, configured and kept up-to-date with regular firmware/software updates.

- Cloud platforms (infrastructure as-a-service (IaaS) backends): are a form of IaaS that offer a scalable enterprise-grade backend for data management of IoT applications and services.

- Application enablement platforms (AEPs): are a form of PaaS that also offer Software-as-a-service (SaaS) solutions enabling developers rapidly create, test and deploy an IoT application or service.

- Advanced analytics platforms: are a form of PaaS that also offer SaaS solutions for sophisticated analytics tools including machine learning techniques and streaming analytics capabilities to extract actionable insights from IoT data.

The fundamental technological components of each IoT platform type are shown in Figure 1:

It is worth noting, that there is one overarching element commonly found in all IoT platforms, regardless of the type:

It is worth noting, that there is one overarching element commonly found in all IoT platforms, regardless of the type:

Data acquisition and IoT Device software development kits (SDKs).

All platforms require some form of data acquisition layer that typically comes in the form of a local software agent on the device so that it can communicate with the platform and other systems. IoT device SDKs, offered by platform providers, enable the building of such agents for data acquisition in the platform. The market report includes more detailed info on each element of the five types of IoT platform.

Market overview

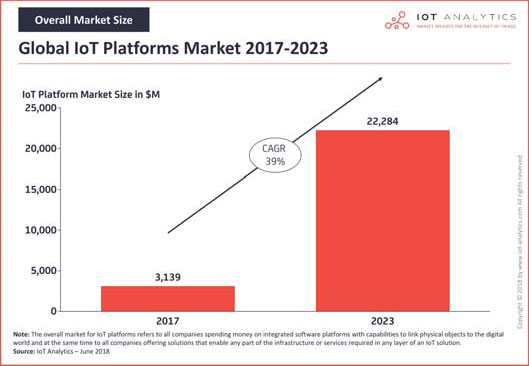

The report forecasts a compound annual growth rate (CAGR) for IoT platforms of 39% over the time frame of 2018-2023, with annual spending surpassing US$22bn by 2023. These numbers are based on the IoT platforms-related revenue of the leading companies in the field, across 11 industry segments – agriculture, connected buildings, connected car, energy, health, manufacturing, public services, retail, smart supply chain, transportation and other.

2017 is the base year for estimates of the IoT platform market, with the overall market value reaching over US$3.1bn. The IoT platform market is expected to be just under US$4.5bn by the end of 2018 and is forecast to grow to almost US$22.3bn by 2023. However, the market remains fragmented with many players competing for market share. Signs of consolidation are only slowly appearing with a number of acquisitions and mergers in the past year – 25 IoT platforms were acquired in 2017 compared to just three in 2013. The fact that this market was more or less non-existent five years ago means most platforms are only a few years old and the nascent market is currently full of early phase IoT projects. IoT Analytics’ recent research shows proof of concepts, pilot projects and small-medium scale deployments account for 80% of identified enterprise IoT projects. Nevertheless, some platforms are now supporting larger roll-outs such as Microsoft connecting thousands of Thyssenkrupp elevators. Platforms are also becoming more mature, with differentiation no longer lying in the big modules, such as from whether they support analytics or device management, but rather in some smaller aspects such as support some specific protocols, having a great user interface or an implementation team with the right know-how.

Segment analysis: The manufacturing segment for IoT platforms surpassed US$1bn in 2017, making it the largest IoT platform segment, and it is forecast to remain so in 2023. The segment has experienced substantial growth in the traditionally large manufacturing-base countries such as the US and Germany.

Regional analysis: Asia emerged as the biggest IoT platform market region by implementation in 2017 driven by strong growth in China. The top three regions are completed by Europe and North America with the other regions MEA, Oceania, South America and the rest of the world only accounting for less than 5% of the total market. High growth is expected to continue in Asia, mainly driven by China, with its large industrial manufacturing footprint offering a huge market with growth potential for IoT platform vendors.

Deep-dive 1: How customers choose an IoT platform

Among other things, the report highlights several examples of how customers select their IoT platforms. For example, an automotive original equipment manufacturer (OEM) in Germany pre-selected ten IoT platform vendors and invited them to perform two-day proof-of-concepts (PoCs) in a real production setting. Vendors were assessed using a number of testing criteria in connecting equipment on the factory floor such as infrastructure, network, IoT, analytics, managed services, security, usability and partner ecosystem – which each may have up to ten weighted sub-criteria. Following this, two of the best vendors were selected for three-month PoCs and were further ranked on their capabilities. Finally, recommendations by the IoT team involved in the PoCs were made to the steering committee and the head of plant automation made the final decision.

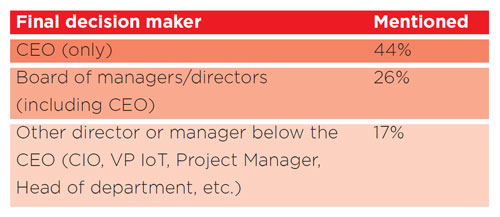

The CEO is often involved in the final decision. In many cases, the final decision is taken by the CEO and/or a management team or board including the CEO following the recommendation made by a team of technical experts, often based on the PoC testing results. Results from a recent survey are presented in the table below:

Using more than one platform is common – switching providers for the same component is rare. The nascent nature of the IoT platform market has resulted in many customers using more than one platform in the proof-of-concepts and pilot projects. Using several different platforms in the exploratory phases can help customers compare and understand which platform works best for their needs. However, switching providers for the same component – for example, the IoT cloud storage – of a platform is rare and to-date has only been triggered by serious technical reasons such as performance issues and/or very unique advantages offered by a component from a different platform.

Using more than one platform is common – switching providers for the same component is rare. The nascent nature of the IoT platform market has resulted in many customers using more than one platform in the proof-of-concepts and pilot projects. Using several different platforms in the exploratory phases can help customers compare and understand which platform works best for their needs. However, switching providers for the same component – for example, the IoT cloud storage – of a platform is rare and to-date has only been triggered by serious technical reasons such as performance issues and/or very unique advantages offered by a component from a different platform.

Deep-dive 2: Partner ecosystem

Building a strong partner ecosystem by embracing collaboration with two-to-three companies from each layer across the technology stack can help a platform stand out from the competition.

Collaboration with partners for hardware (such as chip/device manufacturers or edge intelligence providers), connectivity, cloud data storage/middleware, analytics, security and system integration can help IoT platform vendors from both a technological and business perspective:

- Technological: The technological benefit of collaboration is that the IoT platform vendor can focus on its core technological strengths while relying on expertise from others across its non-core activities to achieve new levels of innovation and increase the value generated from using the platform. Partnerships with hardware vendors are most advantageous, as they enable interoperability between platforms and devices. For example, Telit has launched its own partner programme ‘Ready for deviceWISE’, providing the possibility of partners to certify their devices accordingly.

- Business: A strong partner ecosystem also opens up new business opportunities to get involved on some partners projects and even start combined-selling of collaborative solutions. For platform sales, the best types of partners are system integrators or cloud backend/IaaS vendors as these partnerships can bring the platform vendor closer to the potential users. For larger vendors, whose platform has already been widely adopted, system integrators will, in most cases, already have expert teams trained on their platforms. In contrast, smaller vendors can find it harder to approach a system integrator for partnering up unless they bring a customer along with them to run a PoC or pilot project. For them it is easier to find platform sales leads through partnering with a Cloud Vendor, like Microsoft or Amazon Web Services (AWS). For example, deviceWISE, which hosts its platform on Microsoft Azure, also gains sales leads via Microsoft.

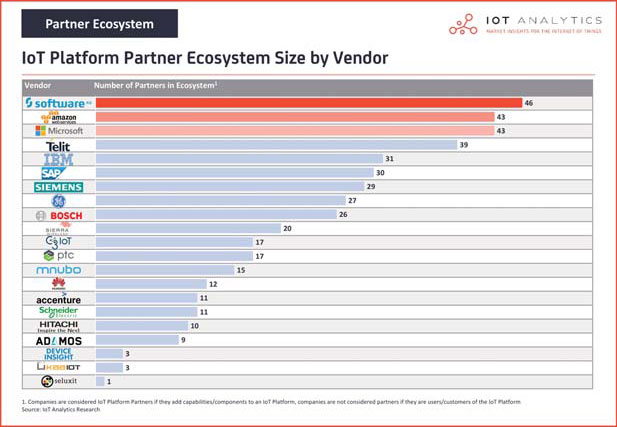

The IoT platform vendor comparison above shows Software AG, Microsoft, and AWS have the most IoT-related partnerships in place. The IoT platform vendors compared in the report on average have 21 companies, thereby Software Ag (46 partners), Microsoft (43) and AWS (43) have more than twice the number of partners which makes them stand out from the rest of the IoT platform vendors.

The IoT platform Cumulocity, which was acquired by Software AG in March 2017 now benefits from the broad partnership ecosystem of Software AG. Since its acquisition Software AG’s Cumulocity has now become one of the top 15 IoT platforms in the market, with the strong partnership ecosystem of Software AG opening many new doors for them in the market. Microsoft and Amazon have also made a big push for their respective collaboration efforts in the last two years and are now reaping the benefits with 90% growth year-on-year to become the top two leading IoT platform vendors by market share.

Conclusion

The IoT platforms market has experienced enormous growth in the last three years. These versatile technology software platforms are gaining in importance across many industries especially in industrial/manufacturing settings. IoT platforms are becoming crucial from an end-user point of view in the digital transformation of their businesses from once standalone products into smart connected solutions. It is becoming evident that choosing a platform provider is not an easy task. Customers have different approaches, however early stage pilots and PoCs are key to success as well as choosing a vendor with a strong partner ecosystem.

IoT Analytics has a dedicated research stream on IoT Platforms. The latest reports are the IoT Platforms Market Report 2018- 2023 and the IoT Platforms Vendor Comparison 2018 – both recently published in June 2018.