Montpellier, France – In a new report on the evolution of mobile location-based services (LBS) IDATE says they have now expanded from traditional maps and navigation services to social networking in the form of check-ins.

Depending on the definition of mobile LBS used, the number of users will differ. Even when taking the narrower definition of traditional mobile LBS (mapping and navigation), IDATE expects the number of users to grow, primarily driven by the overall growth of mobile internet usage, in turn driven by increased numbers of smartphone users. Taking the European Union 5 (EU5 = France, Germany, Italy, Spain & the UK) as an example, traditional mobile LBS users are forecast to stand at 114 million in 2017, up from an expected 79 million in 2012. However, if one takes the wider definition of mobile LBS, for the same EU, the number of users is forecast to be 178 million. The same pattern also applies for the USA and Japan, also covered in the database.

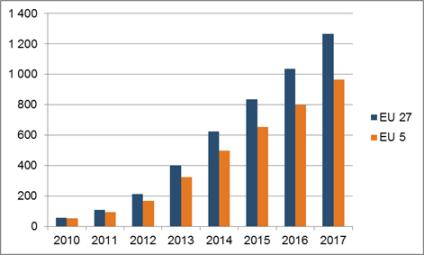

The report gives detailed information about: the market structure, data and forecasts from 2010 to 2017, competition structure and market trends. The table (pictured) shows mobile LBS market revenues, for the EU-27 countries and EU-5*, 2010-2017.

“Mobile LBS on its own has limited competitive advantages, and thus ultimately it is a tool for the juggernauts to further enhance their pre-existing services and business models. Mobile LBS technologies in themselves are readily available in the form of APIs (application programme interfaces) and SDKs (software development kits), and have no differentiating value on their own. In order to make the mobile LBS attractive, various other elements need to be added,” says Soichi Nakajima, senior consultant at IDATE and project manager of this study.

“This means that the internet giants, who already have far-reaching and well-established businesses, are in a strong position to acquire innovative LBS start-ups to further enhance their services. On the other hand, start-ups are finding it hard to make the breakthrough with such giants already in place. Recent acquisitions of leading innovative LBS start-ups, such as Gowalla and WHERE by Facebook and eBay respectively, show the destiny of mobile LBS; mobile LBS is best utilised as an enabling technology, in the form of tools for the juggernauts to enhance their services,” Nakajima adds.

Today, the term ‘mobile LBS’ can include different services depending on different people. Traditionally, LBS tended to refer to mapping and navigational services, very similar in form to the kind of services provided to drivers in their cars, through personal navigation devices (PNDs) or in-car navigation systems.

More recently, however, especially with the rise of smartphones and associated application usage, mobile LBS can cover a much wider range of services, and can be more subtle too. Social networking applications offering check-in options, and services which allow users to search for information in their proximity (such as Yellow Pages or TripAdvisor) all use geolocation services through the mobile phone and can be hence considered as mobile LBS.

In very much the same way as mobile LBS users are described above, the revenue source also differs depending on whether they refer to the traditional or newer form of mobile LBS. Traditionally, the main (or indeed only) source of mobile LBS revenue came from direct user payment for navigation services. Whilst this model still exists more services now use advertising, and it is this advertising model which is expected to drive revenue growth in the future. In particular, mobile advertising on social networks, very small today, is expected to become a force to be reckoned with in the years ahead.

In terms of figures, for the EU5, USA and Japan, IDATE forecasts that revenues from mobile LBS in 2017 will stand at EUR 964 million, EUR 2.4 billion, and EUR 1.9 billion respectively. Since the USA is the most advanced in the advertising market, it will have the largest ratio of advertising within this revenue, whilst Japan has a strong paid-revenue model and thus will have the largest ration for direct-paid revenue. The EU5 has the largest CAGR (compound aggregate growth rate), at 54.5% from 2012 to 2017, largely due to the fact that the market today is yet to develop compared to that of the USA or Japan.

(Table Source: IDATE, Mobile LBS, June 2012)

* EU-5 includes France, Germany, Italy, Spain & the UK