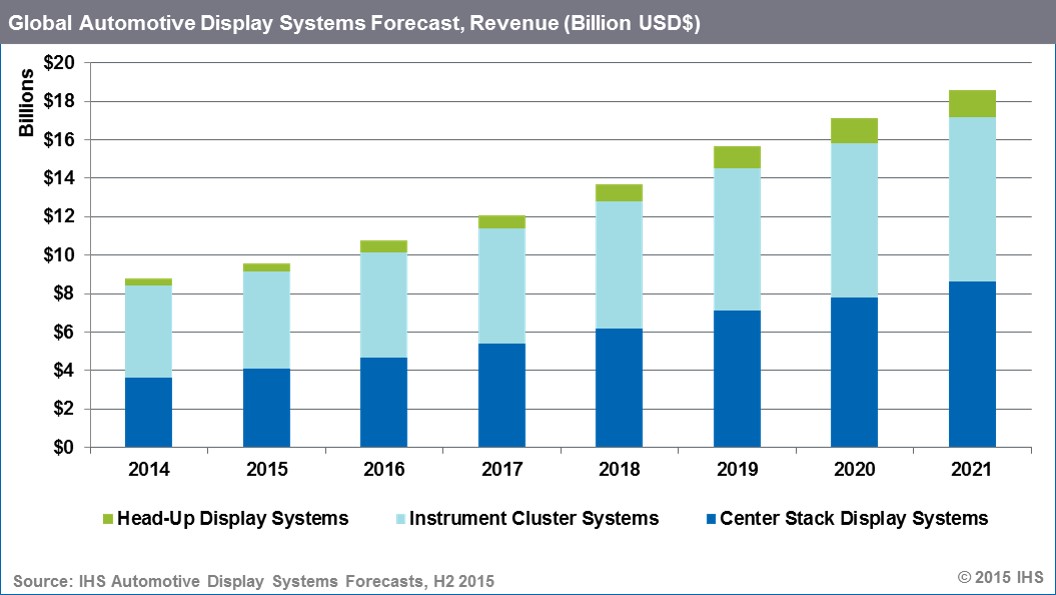

Driven by continued innovation in vehicle connectivity and safety technologies, global revenue from automotive display systems will grow at a compound annual growth rate (CAGR) of more than 11% to $18.6 billion by the end of 2021. This will add nearly $9 billion in annual revenue compared to 2015, according to IHS Inc.

Data from the Automotive Display Systems Forecasts from IHS represents production of instrument cluster systems, head-up display systems and center stack display systems as full automotive modules, not just display panels. Center stack display systems are expected to account for half of the overall revenue growth, while head-up display (HUD) systems will boast the strongest revenue CAGR at nearly 21% from 2015.

“The automotive displays supply chain will see some amazing growth and innovation through the end of the decade, as more vehicles debut new displays or standardise larger ones in the instrument cluster, center stack and head-up display systems,” said Mark Boyadjis, senior analyst and manager for Infotainment and HMI at IHS Automotive. “There is additional growth opportunity in lower volume display applications for rear seat entertainment, HVAC control panels, and new applications such as smart mirrors with full displays entering the market now.”

Global production volumes for factory-installed center stack and instrument cluster display systems are each estimated to grow by more than 40% over the forecast period, each surpassing 60 million units by 2021. IHS forecasts an even higher growth rate for the production of head-up display systems, which will exceed 65%, surpassing 6 million units annually in that same timeframe.

The forecasted global growth in display systems is based on multiple factors. In China, for example, overall volume is boosted, because original equipment manufacturers (OEMs) are beginning to add smaller displays into the instrument cluster and center stack, while regional vehicle sales also grow. Meanwhile, head-up display systems are growing globally, as prices for these new and innovative display technologies fall and they become increasingly relevant to reduce driver distraction.

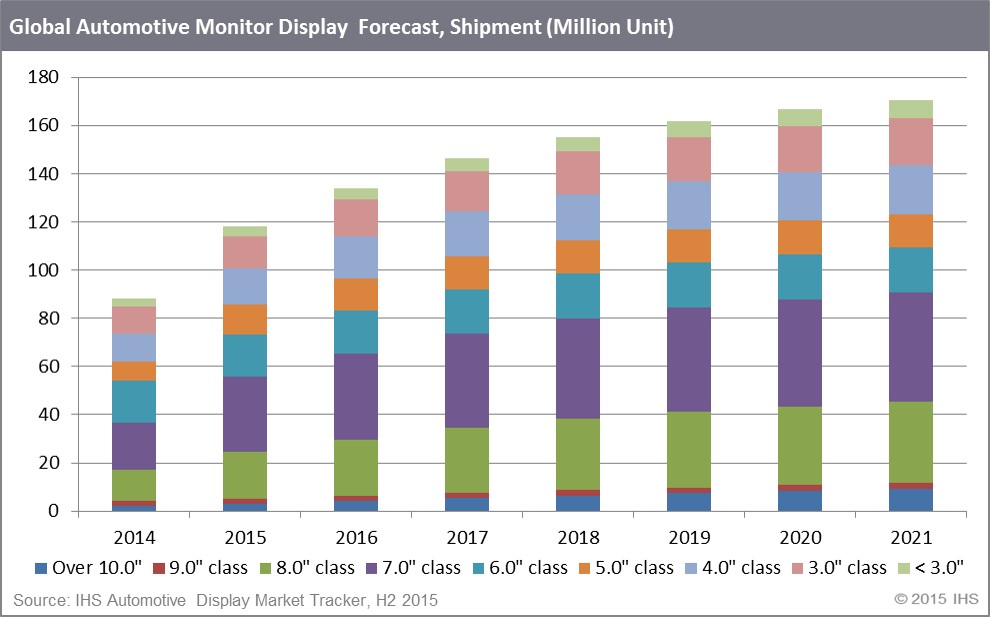

Displays grow in both volume and size

Automotive displays are increasing in volume and in size. IHS forecasts global shipments for automobile display components overall to grow at a CAGR of more than 6% to 170.6 million units by the end of 2021. According to the Automotive Display Market Tracker H2 2015 from IHS, at least two TFT-LCD or AMOLED displays will be in all new cars produced in 2021.

By 2021 automotive displays 7.0-inches and larger are forecasted to reach 33.5 million units, growing at a CAGR of nearly 10%, largely driven by the 8.0-inch size class. “Automotive display sizes are growing quickly to help support multiple infotainment, safety and vehicle system functions that require more screen real estate to inform drivers and passengers,” said Hiroshi Hayase, director for small medium display at IHS Technology. “Vehicles are designed with displays in mind, combining digital clusters, HUDs and center stack displays for a truly immersive experience for the driver.”

Increasing demand for infotainment functions, safety systems and vehicle electrification have persuaded OEMs to consider larger, more complex displays in the center stack, instrument cluster and other applications. Global shipments for instrument cluster displays are shifting from 3.0-inch and 4.0-inch to more than 5.0-inches, and center stack displays are shifting to 7.0-inches and larger. Center stack displays between 8.0-inches and 10.0-inches are already common among high-end vehicles and luxury brands, and they are even being introduced in high-volume vehicles, like D-segment sedans and crossovers.

Aftermarket applications for automotive displays also continue to grow, with high demand for aftermarket navigation systems and radios in China, Russia, and Brazil. These numbers also impact global automotive display shipments.

The Automotive Display Systems Forecasts from IHS provides automotive suppliers and OEMs with timely, reliable, and comprehensive component market data and forecasts with optional customises analysis. The Automotive Display Market Tracker H2 2015 from IHS covers all display panels used in automotive applications, and includes detailed specifications and trends of automotive display market by technology, display size and resolution – including factory-installed and aftermarket applications.

Comment on this article below or via Twitter: @IoTNow_ OR @jcIoTnow