An increasing share of companies are connecting Internet of Things (IoT) devices as part of a global or regional contract, rather than relying on purely national agreements. The appeal of a single contract for multiple countries is clear – more than anything, a single contract is simpler to procure and manage – but these deals raise many complex issues for the buyer.

This whitepaper looks at the increasing importance of global and regional contracts and considers the implications for companies buying connectivity.

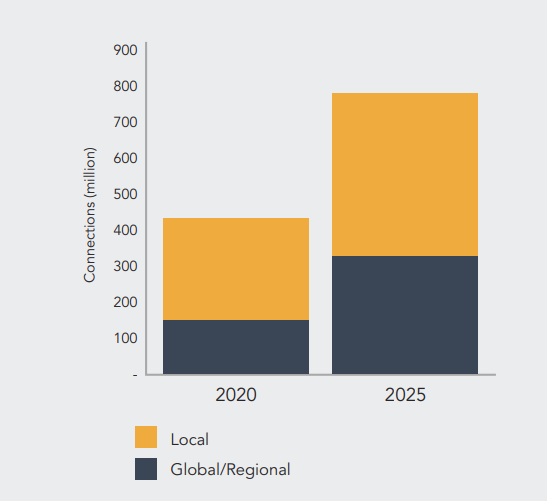

An increasing share of contracts are awarded on a global or regional basis. Global and regional contracts are a large and growing part of the IoT connectivity market. (By global or regional contracts, we mean where a single contract or framework agreement for IoT connectivity covers more than one country.)

[Source: Analysys Mason, 2021]

As shown in Figure 1, Analysys Mason forecasts that there were 430 million cellular connections globally, excluding China, at the end of 2020. 150 million of these connections, or around 35%, were awarded as part of a global or regional contract. By cellular, we mean all 2G, 3G, 4G and 5G connections, excluding Narrowband IoT (NB-IoT) and LTE-M. We have excluded China, as contracts for this market are almost always national.

The IoT connectivity market is forecast to grow strongly, and global and regional contracts will take an even larger share of this market by 2025. Out of the total 780 million connections (again, excluding China), we expect around 43% to be part of a global or regional deal by 2025. The figures for certain regions will be higher than this. For European contracts, for example, the share will be over 50% by 2025

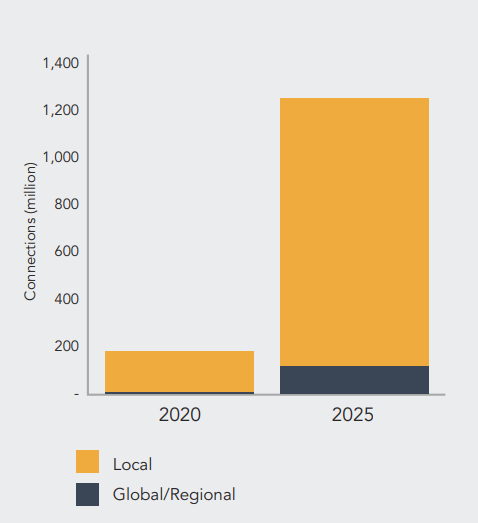

For Low-Power Wide-Area (LPWA), the share that global and regional contracts take will be somewhat lower (see Figure 2) as the types of use cases that LPWA is suitable for are less likely to lend themselves to such deals. For example, contracts for smart metering are almost always awarded locally.

Despite this, we expect that the share of global and regional LPWA contracts will increase, from a very low share today to around 10% in 2025.

[Source: Analysys Mason, 2021]

Car companies have led the way with regional contracts

We have seen many different examples of global and regional contracts. The most obvious, and prominent, is car companies that have signed deals with a single telecoms supplier for multiple countries. These have often been in Europe, as it includes many relatively small countries, but contracts have also been signed to cover the Middle East or Asia.

Other types of businesses have also signed regional and global deals, such as shipping companies for container tracking and even vending machine operators (that is, companies with vending machines in many different countries).

Many factors are driving regional contracts

A number of different reasons explain why customers are buying connectivity in a contract that covers multiple countries.

The first reason, and possibly the most common, is simplicity. The customer has devices – and these could range from tens of vending machines to millions of cars – that will be operational in a number of different countries. The customer will not want to negotiate and manage separate agreements for every country.

The second reason for signing a global or regional connectivity deal is for manufacturers of devices that will end up in an unknown location. These devices will be made in one country (such as China) and then shipped to any of a number of potential countries. The user will want the device to be able to connect legally and cheaply wherever it ends up. A contract that can handle this uncertain final destination is needed.

This reasoning applies to manufacturers of devices, such as connected video cameras, but it can also apply to producers that are active at different parts of the value chain. For example, module and even chipset manufacturers are looking to embed connectivity into their products. In these examples, the module or chipset manufacturer will procure connectivity without knowing what device their product will be used in, let alone where it will be used. In this case, some sort of global or regional connectivity deal is essential.

The final common reason for buyingconnectivity as part of a global or regional agreement is for devices that will roam across borders. For example, this could include the tracking of shipping containers that will require connectivity in different countries. The customer could rely on a standard contract with roaming included, but they want to be sure they have competitive pricing and a legal solution.

Customers have a few different possible options for buying regional or global connectivity

• Global (roaming) SIM. The SIM has the profile of an operator in one country. It will act as a roaming SIM when it is in other countries.

• Multi-IMSI. The SIM has multiple different operator international mobile subscriber indentity (IMSI) profiles installed on it. For example, it may have the IMSI profiles of operators in five countries. If the device is in one of these five countries, it will switch to a local international mobile subscriber identification (IMSI) and act like a standard domestic SIM. In other countries, it will act as a roaming SIM.

• IMSI installed over the air. A local operator’s IMSI profile is dynamically downloaded to the device depending on where the device is located; the SIM will then act like a local SIM. eUICC is one version of this option, but other proprietary solutions are also available.

Car companies have led the way with regional contracts

We have seen many different examples of global and regional contracts. The most obvious, and prominent, is car companies that have signed deals with a single telecoms supplier for multiple countries. These have often been in Europe, as it includes many relatively small countries, but contracts have also been signed to cover the Middle East or Asia.

Other types of businesses have also signed regional and global deals, such as shipping companies for container tracking and even vending machine operators (that is, companies with vending machines in many different countries).

Many factors are driving regional contracts

A number of different reasons explain why customers are buying connectivity in a contract that covers multiple countries.

The first reason, and possibly the most common, is simplicity. The customer has devices – and these could range from tens of vending machines to millions of cars – that will be operational in a number of different countries. The customer will not want to negotiate and manage separate agreements for every country.

The second reason for signing a global or regional connectivity deal is for manufacturers of devices that will end up in an unknown location. These devices will be made in one country (such as China) and then shipped to any of a number of potential countries. The user will want the device to be able to connect legally and cheaply wherever it ends up. A contract that can handle this uncertain final destination is needed.

This reasoning applies to manufacturers of devices, such as connected video cameras, but it can also apply to producers that are active at different parts of the value chain. For example, module and even chipset manufacturers are looking to embed connectivity into their products. In these examples, the module or chipset manufacturer will procure connectivity without knowing what device their product will be used in, let alone where it will be used. In this case, some sort of global or regional connectivity deal is essential.

The final common reason for buyingconnectivity as part of a global or regional agreement is for devices that will roam across borders. For example, this could include the tracking of shipping containers that will require connectivity in different countries. The customer could rely on a standard contract with roaming included, but they want to be sure they have competitive pricing and a legal solution.

Customers have a few different possible options for buying regional or global connectivity

• Global (roaming) SIM. The SIM has the profile of an operator in one country. It will act as a roaming SIM when it is in other countries.

• Multi-IMSI. The SIM has multiple different operator international mobile subscriber indentity (IMSI) profiles installed on it. For example, it may have the IMSI profiles of operators in five countries. If the device is in one of these five countries, it will switch to a local international mobile subscriber identification (IMSI) and act like a standard domestic SIM. In other countries, it will act as a roaming SIM.

• IMSI installed over the air. A local operator’s IMSI profile is dynamically downloaded to the device depending on where the device is located; the SIM will then act like a local SIM. eUICC is one version of this option, but other proprietary solutions are also available.

The different options are separate from the form factor of the SIM itself. Each of the three basic options outlined above could work with a standard physical SIM, an embedded or integrated SIM (eSIM or iSIM).

Each of the three options has advantages and disadvantages. The selection of the customer will depend on the use case. For example, for a fleet tracking solution in Europe, a global European SIM may be the best option, as switching profiles involves some complexity and cost. For a device that will not move once it is operational, such as a vending machine, an embedded universal integrated circuit card (eUICC) option may be a better option than a global roaming SIM.

This then leads us to discuss the purchasing criteria for an organisation.

Companies need to weigh different requirements when purchasing connectivity

Purchasers of IoT connectivity as part of a global or regional contract will have many different considerations when selecting a provider. The priority or weight given to the various aspects will vary by customer.

The primary considerations are:

• Coverage: Mobile networks were built to connect people and not things. This means while connectivity in cities is typically good, coverage of rural areas can be poor. This can affect IoT devices, particularly if the use case requires connectivity in remote areas, such as agricultural solutions. Especially for countries with a large landmass and low population density (Australia, Canada, USA), coverage by operator can vary significantly, making coverage an important consideration for connectivity buyers. Some customers may even be willing to pay a premium to connect to different network providers in a country, ensuring that the device always has the best possible connectivity.

• Network: The network agreements of different providers vary. For example, a connectivity provider may not have access to 4G connectivity in some countries. Access to 5G networks will also vary by provider. Agreements for NB-IoT or LTE-M connectivity may not be in place, even if standard 4G connectivity is available. Even where NB-IoT roaming is available, the charging schemes may not make them attractive for use cases that generate low revenue. The buyer of connectivity needs to investigate what is being offered by their supplier in the countries where they will be operating. • Operator reputation. There are well over 50 mobile virtual network operators MVNOs and mobile network operators MNOs that can offer international connectivity, but these vary from small players with under 1 million SIMs to the largest global operators with tens of millions of connections. The reputation and financial position of the provider will be an important consideration, especially for IoT contracts that will have a long duration (for example, for devices with a lifetime of five or more years).

• Other services. The customer may want more than just connectivity from their supplier. Often customers want a connectivity management platform that allows them to monitor and manage their SIMs. They may also demand other features such as device management platforms, integration with cloud providers, hardware testing and certification and even hardware itself. Buyers need to consider what additional support they need from their connectivity provider when making their selection.

• Permanent roaming. Permanent roaming has two aspects – regulatory and contractual:

- Regulatory aspects: Some country’s regulators do not allow SIMs that permanently roam on their domestic networks (for example, Saudi Arabia, Brazil). These bans may not always be explicitly stated in the regulations, adding extra confusion. Buyers will need reassurance from their providers that permanent roaming is allowed where they will operate if they are considering this option.

- Contractual aspect. Almost all mobile operators have roaming agreements with one other, but these were designed around the needs (and consumption) of smartphones. These reciprocal agreements often offer relatively competitive roaming rates but only for devices that are temporarily roaming (for instance, devices that are in the country for fewer than 90 days). While the numbers of IoT connections were relatively small, operators may not have policed these terms too strictly, but we know this is becoming a more important issue. For SIMs that permanently roam, customers may need to pay a monthly surcharge if they are to remain connected. Again, the IoT connectivity customer needs a provider that can navigate these complex agreements and guarantee that additional charges will not hit them during the contract.

• Operator lock-in. In a smartphone, the process of swapping a SIM is straightforward. In an IoT device, it is far more complex. Consider connected solar panels in remote locations or a fleet of lorries that drive across a continent; the process of switching SIMs on each device would be extremely challenging. As a result, customers may prefer models that allow them to switch providers without swapping a removable SIM. Furthermore, as removeable SIMs are superseded by eSIMs and iSIMs that are built into the device, replacing a SIM will no longer be possible.

• Latency. Most IoT uses are, in theory, tolerant of high latency. For example, a smart meter does not need to communicate with sub-10 millisecond latency. However, latency can impact battery life, and so is a consideration even if the use case does not need very low response times. For example, consider a battery-powered device communicating using NB-IoT. This device will want to wake up, send and receive messages as quickly as possible before going back into sleep mode. If the need to communicate with a core network on a different continent delays this process, more power will be consumed, and the device’s overall lifetime diminished. An operator that can offer lower latency will help this IoT customer.

• Data sovereignty. Local regulators may have requirements about where data is stored and processed. IoT service providers sometimes ignore these rules as they know that regulators do not police them tightly. However, as IoT becomes more important, regulators may take a closer look and enforce regulation more strictly. Customers will want to be protected by their service provider and not risk losing connectivity midway through a contract.

• Billing. With devices across various networks in different countries, the customer may only receive billing information at the end of the month. This makes it difficult for the customer to react in real-time to problems with a device (for example, if a device is not connecting to the network). More advanced price plans, such as pooled plans across different countries/host operators or different billing models for low ARPU devices (for example, per message rather than per MB), may not be supported across all countries. Again, for certain use cases, these factors will be important for the buyer of connectivity and are issues that should be raised with potential suppliers.

Global and regional deals are becoming more common, and this is raising new questions

As we saw at the beginning of this article, the number of connections that will require a global or regional deal will increase over time. In part, this is driven from the supply side – technology developments such as roaming agreements for NB-IoT networks and advances in eUICC means that global or regional contracts can apply to more use cases.

The demand side is also pushing the increase in global and regional deals. Customers with a handful of connections in a small number of countries could manage separate contracts. As volumes increase though, more advanced solutions are required.

This increase in volumes is also pushing issues up the agenda for domestic operators and regulators. When the number of SIMs was low, operators and regulators might ignore violations of permanent roaming regulations or of local data rules. As the sheer numbers increase though, pressure rises to police these issues more closely.

No single solution for all types of global or regional connectivity contract exists. Each customer and use case will need a different solution, depending on the specific region, business model and more. IoT connectivity buyers should make sure they are aware of the considerations outlined in this article and that any proposed solutions meet their needs.

Comment on this article below or via Twitter: @IoTNow_