LoRaWAN is the leading technology in the licence-exempt low power wide area (LPWA) space, accounting for around 270 million end points as of August 2022. The ecosystem associated with the technology is dynamic and evolving. Initially, the technology gained traction in campus area private networks, but now momentum is growing in wide area and public network contexts bringing new network and data management challenges. This report, written by Jim Morrish, a co-founder of Transforma Insights, unpicks some of the detail behind these three stages.

LoRaWAN has two key characteristics that make the technology particularly suitable for certain IoT markets. Firstly, it is a LPWA technology meaning that LoRaWAN connected devices can be battery powered with battery lives of potentially several years and also LoRaWAN networks have the potential to be deployed as wide area public networks, much as cellular networks are currently deployed today. Secondly, LoRaWAN operates in licence-exempt spectrum which means that an end-user or network provider does not need to first procure radio spectrum before deploying a network. In combination, these characteristics make for cheap and easy network deployment to provide connectivity for battery powered sensing or actuating devices that can operate for potentially years with minimal maintenance requirements.

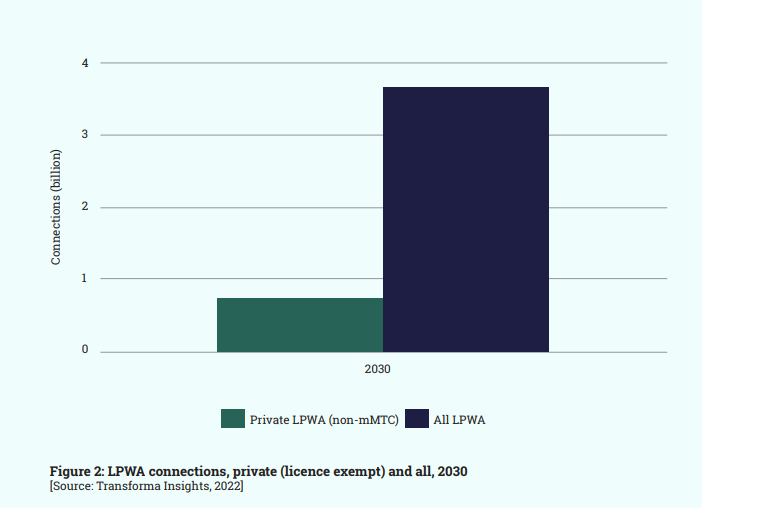

The trade-off for this flexibility lies in LoRaWAN’s limited data rates, which are much lower than today’s cellular technologies but are often perfectly adequate for IoT devices. By 2030, Transforma Insights forecasts that there will be 6.9 billion wide area wireless IoT connections, of which 36% will be traditional cellular technologies while 4.4 billion will be LPWA technologies. Of this figure, we expect that around two-thirds will be massive machine-type communications (mMTC) connections operating in licenced spectrum and one-third will be connected using licence-exempt LPWA technologies, but this split might vary depending on how quickly licence-exempt wide area public networks are deployed.

Gaining traction: LoRaWAN in a campus area private network context

Given the strengths of LoRaWAN as described above, it is unsurprising that much of the early adoption of the technology has been driven by campus area deployments of private networks. It is a simple exercise for any enterprise end-user to deploy their own network, connect devices, and reap significant benefits.

Key scenarios include the deployment of networks to support inventory management and monitoring, including stock level monitoring and warehouse management systems which can reduce the load on warehouse employees, freeing them up for other higher skilled tasks. Meanwhile, greater knowledge of the stored quantity of goods and their flow enables the optimisation of inventories, allowing businesses to operate with a leaner inventory reducing the space and capital dedicated to inventory, or for a greater variety of goods for a given floor space.

LoRaWAN is also ideally suited for deployment as a campus area network in agricultural contexts, in support of devices ranging from soil-moisture sensors to temperature sensors in greenhouses, and from storage tank level monitoring to enabling remotely controlled irrigation systems. In other enterprise contexts the technology is well-suited to monitoring the location and condition of various assets, enabling building automation solutions, and many other applications.

However, today’s deployments of LoRaWAN networks have not been exclusively limited to campus area networks. Often networks have been deployed as wide area private networks, particularly to support applications such as smart metering and public space lighting, including street lighting. Deployment of networks for street lighting in particular can unlock new opportunities. For example, in January 2022, Sydney-based National Narrowband Network Company (NNNCo) signed a contract with technology provider Wellness TechGroup, to provide IoT network coverage to 70,000 smart streetlights in Montevideo, the capital of Uruguay. The project will cover 200 square kilometres and provide smart street lighting to more than 1.3 million people. It will also establish a LoRaWAN network that can be used to support other smart city initiatives, potentially including applications such as smart parking and road traffic monitoring and control.

To date, a significant driver for the deployment of LoRaWAN networks (and devices) has been for reasons of cost reduction and efficiency. But there are other factors that can drive deployment, including compliance with regulations and worker health and safety.

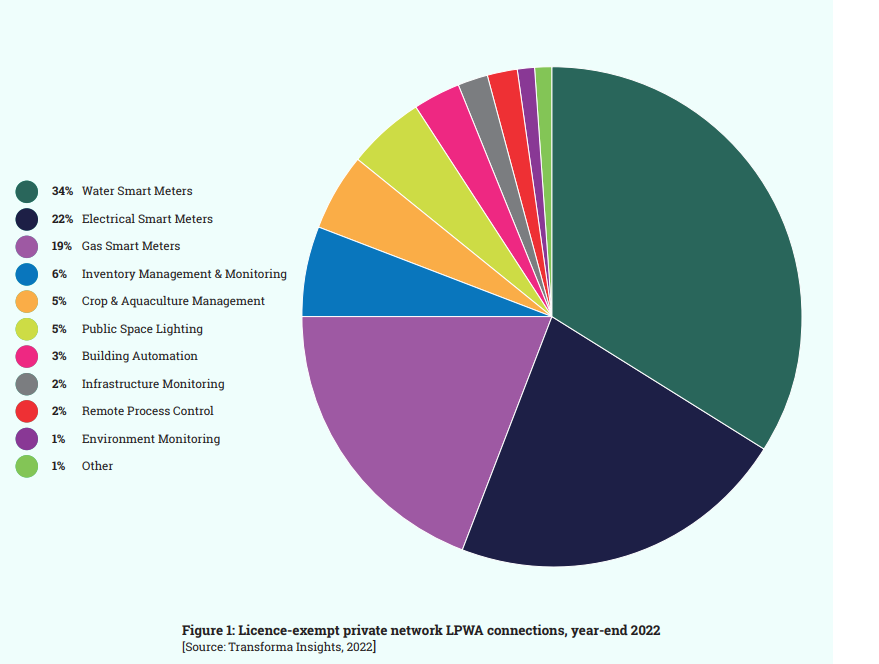

A key factor to note here is that the wide area applications listed above will typically involve many more end points per deployment than will campus area deployments. Accordingly, whilst the centre of mass of the LoRaWAN market activity to date has been campus area private networks, it is in fact wide area private networks that account for the majority of connections. Figure 1 summarises Transforma Insights market forecasts for 2022, highlighting the applications that comprise today’s installed base of licence-exempt LPWA private network connections.

Extending reach: LoRaWAN as a wide area public network

Clearly, the deployment of LoRaWAN wide area public networks represents a significant opportunity for the entire LoRaWAN ecosystem since, as is clear from the profile of connections in Figure 1, the largest opportunities in terms of device count tend to rely on wide area coverage. So far that wide area coverage has generally but not exclusively been provided by private networks.

Currently there are 173 public LoRaWAN network operators worldwide, although this figure will include everything ranging from operators that have nationwide coverage through to campus deployments that allow inbound roaming. Amongst the most significant of these Orange, Swisscom and KPN all offer nominally nationwide LoRaWAN public networks in France, Switzerland and the Netherlands respectively.

However, the deployment of LoRaWAN as a wide area public network technology is rapidly gaining momentum. In this context, it is worth calling out three companies: Everynet, Helium, and Senet.

Recently, Everynet has pursued a strategy to roll-out such networks, starting in Brazil and following with the USA and Indonesia. The company’s networks cover more than 50% of the population of Brazil and more than 40% of the population of the USA and Everynet will enhance this baseline coverage according to customer demand. Next priorities include several larger European countries.

Meanwhile Helium claims to offer the largest LoRaWAN network in the world. Hotspots or access points can be deployed by any individual or business and offer coverage as part of the Helium network in return for payment, enabled and administered using distributed ledger – Blockchain – technology. Currently the Helium network is comprised of around 850,000 LoRaWAN hotspots. Senet positions itself as a carrier grade network provider and has a two-way roaming agreement with Helium. Senet itself, in September 2022, announced that it is has expanded the build out of its public LoRaWAN network across all five boroughs of New York City.

It is worth noting that a number of satellite operators also offer direct-to-satellite LoRaWAN coverage, supported by the long range – frequency hopping spread spectrum (LR-FHSS) enhancement to the LoRa standards announced in late 2020. LR-FHSS data rates significantly increase network capacity and robustness to interference. Operators include EchoStar Mobile, Eutelsat, Fleet Space, Lacuna Space and Wyld Connect.

Such wide-area public networks enable out of the box connectivity and allow for connected solutions can be sold to consumers through normal commercial channels. In addition, many enterprise IoT solutions also rely on wide-area public networks, for example fleet monitoring solutions, asset location solutions, and so on. Figure 2 highlights the scale of the opportunity. The green colour represents our current forecasts of licence-exempt LPWA solutions deployed as private networks reaching 728 million connections by 2030, whilst the blue colour represents the full market opportunity for LPWA (including mMTC in licenced bands and devices supported by public LPWA networks) reaching a total addressable opportunity of 4.4 billion connections. As such, deploying LoRaWAN as a wide-area, public network technology unlocks a significant market opportunity.

Implications for network and data management

Clearly, LoRaWAN network coverage is fast evolving and is supported by a diversity of providers. However, this situation does bring about a range of challenges, not least in terms of how to manage a device estate that might potentially be distributed across many different networks (and network types and network providers). From an end-user perspective, several different aspects of a device estate need to be managed, including data sourced from devices, interfaces to associated networks supporting data communications, and the device itself. For instance, in the case of a supply chain monitoring solution (see p.64) devices might connect to any of multiple private campus networks and public wide area networks. To manage such a device estate efficiently an end-user will want oversight of all devices and connections from a single interface. The end-user will also want all data to feed in to a single platform so that data from different devices can be combined to support advanced applications and data analytics.

Such analytics could range from relatively simple benchmarking to identify any devices that return readings that are in some way unusual or unexpected, through to artificial intelligence (AI)-enabled dynamic system optimisation. In essence, the combination of data sourced from multiple devices and communicated via multiple networks into a single data platform enables an enterprise application to efficiently span the entire device estate, drawing on data from specific devices (and controlling and actuating those devices) as required. It also allows for significantly more sophisticated analysis of data from individual devices, and from the device estate as a whole, so enabling more effective and efficient management of end-to-end solutions.

LoRaWAN supporting the cold chain: an illustrative scenario

The monitoring of cold chains serves to illustrate each of the three stages of development of LoRaWAN, from a campus private network context to a wide area public network context and highlighting some of the analyses that can be applied to data received from various sensors.

A campus area private network solution

Significant benefit can be gained from monitoring chillers and refrigerators in retail, hospitality, medical and warehouse contexts. In all these cases a simple LoRaWAN temperature sensor connected to a private network can provide regular temperature readings and help to ensure that refrigeration units are maintaining correct temperatures, so reducing spoilage and waste. Variances in the temperature profile maintained by refrigeration units can be an early indicator of imminent breakdowns and so alert engineers to undertake pre-emptive maintenance before a breakdown occurs. In turn, well-maintained refrigeration units will work more efficiently and so reduce electricity consumption. In hospitality contexts in particular, a temperature sensor can provide useful insight into the frequency with which customers open a specific unit, providing information that can be used to help manage stock levels.

Besides economic benefits, temperature monitoring and control solutions can also unlock sustainability benefits due to reduced wastage of produce and by shifting electricity consumption to periods when more renewable energy is available. Pre-emptive maintenance can enable more efficient field force operations, significantly reducing vehicle mileage and fuel consumption.

Enhancements using wide area public networks

Extending the reach of monitoring solutions to include supply and distribution networks, including on-board vehicles and in distribution hubs, allows for significantly enhanced functionality. Such solutions can monitor chilled produce across an entire supply chain, possibly using LoRaWAN connected sensors integrated into packing crates to support temperature sensing at a very granular level and potentially also providing real-time location information. The benefits of such solutions are clear: managers responsible for a cold chain are able to monitor goods at every stage of distribution to identify and potentially take mitigating action if temperatures vary outside of specified bounds. This helps to ensure the quality of goods when they are supplied to customers. In addition, particularly solutions that include location information can help to combat the loss, or theft, of goods in the supply chain.

Insightful data analytics

Drawing together information provided by sensors across an entire cold chain better enables supply chain optimisation. Potentially real-time demand information sourced from refrigerated cabinets in hospitality contexts can be used to optimise delivery routes so that stocks can be replenished at appropriate intervals. Such an approach can again unlock significant efficiencies in distribution networks and also associated sustainability benefits due to reduced fuel consumption. Sensing demand at a more granular level can allow a hospitality industry supplier to pivot to an as-a-service business model, for instance committing to maintain certain stock levels within a wine chiller.

Central systems are also well-placed to monitor electricity tariffs and to optimise the temperature of individual refrigeration units by reducing temperatures immediately before peak tariff periods, so saving electricity consumed during those peak periods. Consumption can also be optimised to make the maximum use of electricity sourced from renewable generation.

Comment on this article below or via Twitter: @IoTNow_OR @jcIoTnow